Personal Solutions

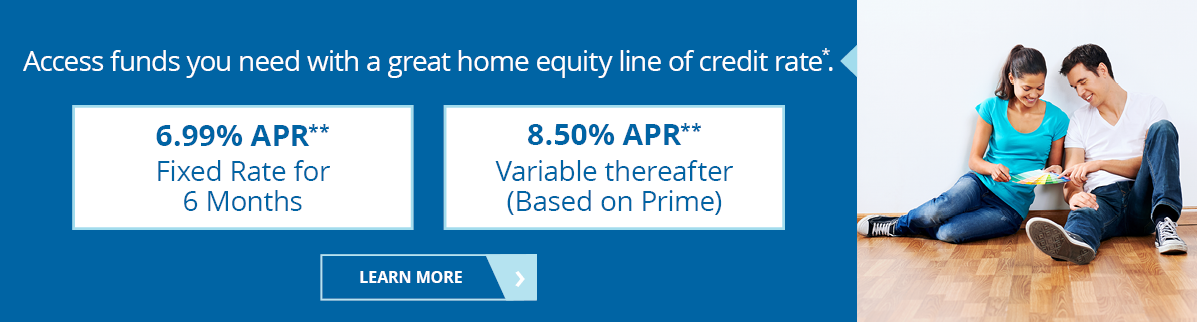

We empower you to meet your financial goals with the expertise and suite of services we've designed with you in mind.

Strengthening Businesses

As a trusted business partner, we invest in local businesses. When they thrive, it helps our great state's economy grow and prosper.

Supporting Community

For 200 years, we have been supporting those in need by giving back to local charitable organizations and investing in community development.

BNWise

THE KEY TO EDUCATION IS BNWISE

BankNewport's financial education program, BNWise, offers the knowledge and skills you need to make the best financial decision for you or your family.

OceanPoint Marine Lending

EXPERIENCED MARINE FINANCING

Present or future boaters can find personalized marine financing programs for new and used boats and refinancing for existing boat loans. Competitive rates, dedicated buyer support, quick access to funds, and more.

OceanPoint Marine Lending

EXPERIENCED MARINE FINANCING

Present or future boaters can find personalized marine financing programs for new and used boats and refinancing for existing boat loans. Competitive rates, dedicated buyer support, quick access to funds, and more.

OceanPoint Investment Solutions

comprehensive financial services

Our advisors will work with you to create a powerful portfolio designed to help guide all types of investors towards financial well-being.

BankNewport In the News

BankNewport Promotes Evan Rose to Premier Banking Manager

April 15, 2024

NEWPORT, R.I. (April 10, 2024) – BankNewport is pleased to announce that Evan Rose has been promoted to vice president, premier banking manager. Rose has been with the Bank for over 14 years, having held several leadership and management positions within the Retail Group, most recently as vice president, retail sales support manager, where he […]

READ MOREBankNewport Celebrates Opening of the MLK Center’s Newly Renovated Community Center and Food Pantry in Newport

February 21, 2024

NEWPORT, R.I. (February 21, 2024) – The Dr. Martin Luther King, Jr. Community Center recently held a ribbon-cutting ceremony for its newly renovated facility at 20 Dr. Marcus Wheatland Boulevard in Newport, RI, marking the culmination of 13 months of construction. This significant milestone not only honors the legacy of Dr. King, but also signifies […]

READ MOREMessages of Love and Support: BankNewport’s “Heartwarming” Sponsorship Spreads Joy at Garden City Center

February 14, 2024

Visitors can write and send postcards of kindness either to loved ones and community members in need NEWPORT, R.I. (February 14, 2024) – This February, the power of kind words takes a tangible form at Garden City Center in Cranston, RI. Sponsored by BankNewport, the “Heartwarming” event and art installation encourages community members to express […]

READ MOREBankNewport Highlights 2023 Community Investment

January 17, 2024

NEWPORT, R.I. (January 17, 2024) – BankNewport is pleased to announce that its 2023 philanthropic efforts resulted in over $1.6 million in giving and over 10,000 employee service hours throughout Rhode Island. The funding was inclusive of charitable grants, contributions, community event sponsorships and donations through its local Bank branches. Over 400 organizations were impacted by […]

READ MOREFHLBank Boston awards BankNewport $850K grant to support construction of 54 affordable apartments in R.I.

January 4, 2024

PROVIDENCE – BankNewport recently received an $850,000 grant from the Federal Home Loan Bank of Boston, which it will use to provide construction financing for affordable apartments in Portsmouth. The grant is part of an overall $37 million in grants, loans and interest- rate subsidies from FHLBank Boston to support 29 affordable housing initiatives […]

READ MOREBankNewport Awards More Than $115,000 in Fall 2023 Grants

December 20, 2023

Newport, RI – (December 19, 2023) – As part of its All In Giving program, BankNewport is pleased to announce that it recently awarded over $115,000 in grant funds to 31 organizations throughout Rhode Island that focus on areas of need including basic needs and food insecurity, education and workforce development, children and families, arts […]

READ MOREBankNewport Named Top SBA 504 Third-Party Lender in Rhode Island for Sixth Consecutive Year

December 13, 2023

NEWPORT, R.I. (December 8, 2023) – BankNewport was recently recognized by the U.S. Small Business Administration’s Rhode Island district office as the top 504 Third Party Lender of the Year for Fiscal Year 2023. BankNewport has earned this distinction for six consecutive years, and 12 of the last 13 years. “BankNewport’s legacy of over […]

READ MOREBankNewport Supports Establishment of El Centro, a Vital Community Center for Residents in Central Falls, with $25,000 Grant

December 11, 2023

NEWPORT, R.I – December 11, 2023 – BankNewport is proud to announce a $25,000 grant toward the establishment of El Centro, a transformative one-stop supportive community center designed to address critical needs within the Central Falls, RI community. El Centro aims to provide comprehensive support for residents, focusing on essential areas such as food and […]

READ MOREBankNewport Names Patrick Laundry Senior Vice President, Director of Business Intelligence & Strategic Planning

December 7, 2023

NEWPORT, R.I. (December 6, 2023) – BankNewport is pleased to announce that Patrick Laundry has been named senior vice president, director of business intelligence & strategic planning. In his new role, Laundry will be responsible for the development, delivery, and coordination of analysis of bank data, market trends, and the competitor landscape to inform strategic […]

READ MOREBankNewport Celebrates Ranking As One of the Nation’s Best Banks to Work For

November 24, 2023

NEWPORT, RI – (November 22, 2023) – BankNewport was today named one of the 2023 Best Banks to Work For by American Banker magazine as part of its annual list organized by the Best Companies Group to identify banks that excel at creating positive and supportive workplaces for employees. On the 2023 list, BankNewport […]

READ MORE