OceanPoint Financial Partners, MHC Report Record Year at Annual Meeting

05.18.20

NEWPORT, RI (May 18, 2020) – BankNewport announced record results for 2019 at the annual meeting of OceanPoint Financial Partners (the “Company”), the mutual holding company of BankNewport and OceanPoint Insurance held via proxy vote on Wednesday, April 29, 2020. At year-end, total assets increased to a record-high of $1.75 billion, and the organization has diversified to include marine lending and wealth management, in addition to banking and insurance.

BankNewport’s lending team originated a record number of loans in 2019. The Bank’s loan portfolio grew to $1.41 billion and for the first time in the Bank’s history, commercial loan balances surpassed $700 million.

BankNewport’s Retail and Business Banking Groups continued to be successful in growing deposits and in launching new products, services and technologies. Deposits grew $64 million to a record $1.41 billion.

OceanPoint Insurance continues to design insurance programs for personal insurance, business insurance, and employee benefits, serving clients through five office locations throughout the state. Revenues for the agency grew 11% in 2019.

Technology investments were made to provide customers with a convenient, accurate and secure banking experience. Significant year over year increases were realized with mobile deposits and on-line banking transactions. Customers used their debit cards over 5.2 million times to purchase almost $222 million of products and services. The introduction of Zelle, along with enhanced options to telephone voice response, provided a higher degree of security and convenience for customers. Personal Teller Machines (PTMs) continue to be added across BankNewport’s footprint, and “live chat” capabilities were added to the Call Center.

Physical expansion of BankNewport included the opening of an 18th branch at 1423 Hartford Avenue in Johnston. In addition, the bank invested $5 million to the historic restoration of its Newport Washington Square branch while retrofitting it to meet the needs to today’s customer, a project set to reach completion at the end of May.

The bank rebranded its marine lending business to OceanPoint Marine Lending, a Division of BankNewport, specializing in consumer marine and recreational vehicle financing programs, with an experienced team operating along the East Coast with offices in Rhode Island, New Jersey, Maryland and Virginia. Also introduced was OceanPoint Investment Solutions through a relationship with LPL Financial, to provide access to comprehensive financial and investment advisory services*.

Efforts in 2019 earned BankNewport Rhode Island Monthly’s “Common Good Award,” while also being named one of the “Best Places to Work” and “Fastest Growing Companies” by Providence Business News.

In 2019, BankNewport awarded over $1 million in grants, sponsorships, and donations to a wide range of various nonprofits, and an investment of over 9,000 hours of financial education and volunteer activities conducted by our employees.

“We are so appreciative of every employees’ contribution to our success in 2019,” said Sandra J. Pattie, President & CEO, BankNewport. “Now, as we begin 2020 facing a great global challenge, we are heartened by BankNewport’s 200-year history of standing strong through difficult times, and know that we will continue to meet customer needs, together, with a positive outlook for our future.”

President Sandra Pattie also announced the appointment of six new BankNewport Corporators during the annual meeting: Joseph Catelli of South Kingstown; Kathryn Schibler Conn of Exeter; Ghassan H. Daou of Providence; Adriana Dawson of Pawtucket; Mark M. Thayer, Esq. of Portsmouth; and Barry M. Westall of Jamestown. Corporators play an essential role in promoting the mission and vision of a mutual community bank. They are ambassadors that represent the communities served by BankNewport and OceanPoint Insurance.

About OceanPoint Financial Partners, MHC

OceanPoint Financial Partners, headquartered in Newport, Rhode Island, is a Mutual Holding Company. Through BankNewport and OceanPoint Insurance Agency, Inc., the Company is proud to serve the financial and insurance needs of families and businesses from 18 full-service banking offices, two commercial lending offices, and five full-service insurance offices located throughout Rhode Island.

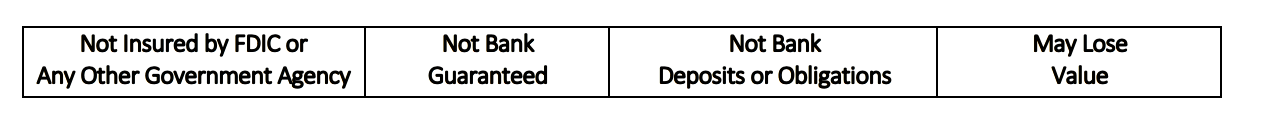

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. BankNewport and OceanPoint Investment Solutions are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using OceanPoint Investment Solutions, and may also be employees of BankNewport. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, BankNewport or OceanPoint Investment Solutions. Securities and insurance offered through LPL or its affiliates are: